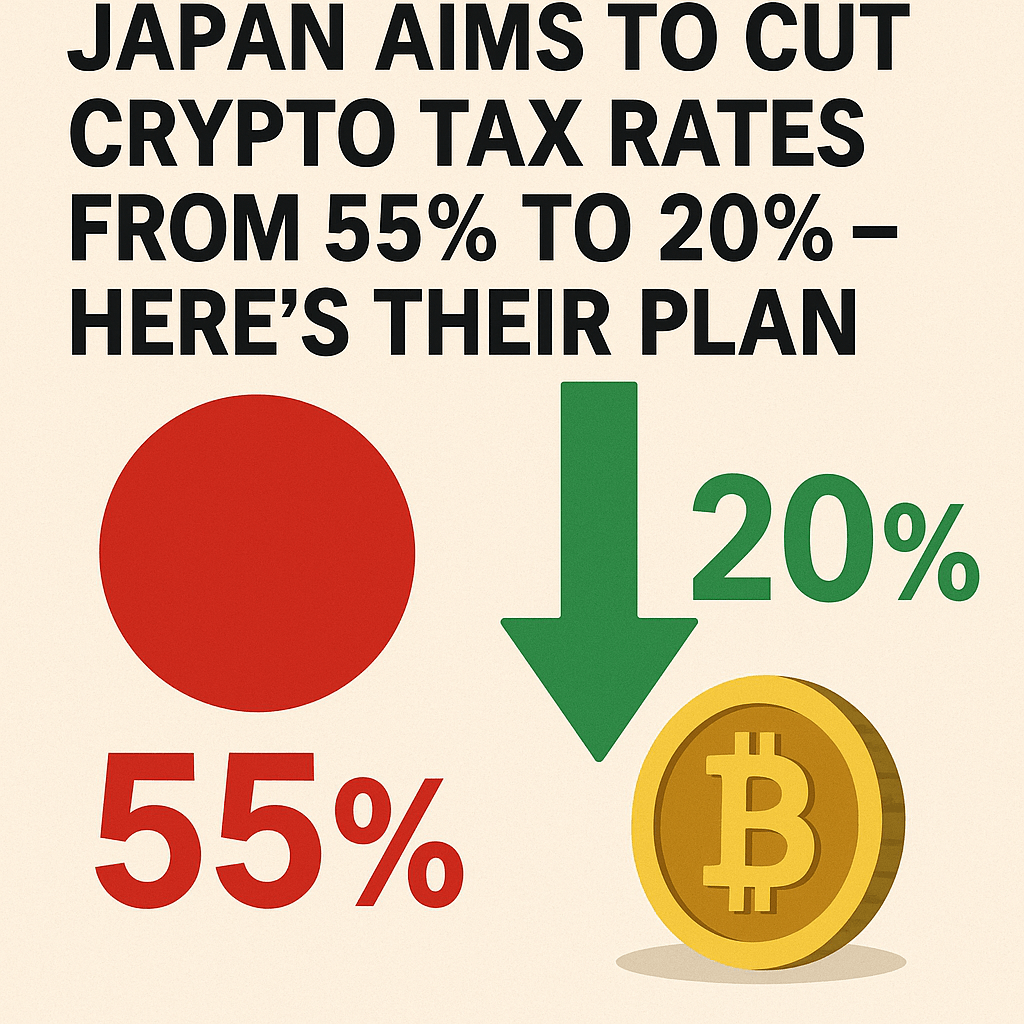

Japan Aims to Cut Crypto Tax Rates from 55% to 20% – Here’s Their Plan

Japan is taking significant steps to overhaul its cryptocurrency tax regulations as part of broader efforts to foster a more accommodating environment for blockchain innovation and digital asset adoption. The current rules, which have been in place for years, are viewed by industry experts as a barrier to the growth and maturity of the country’s vibrant crypto sector. The proposed adjustments aim to simplify tax procedures and clarify how various digital assets are taxed, encouraging more participation from both retail and institutional investors.

Reforming Cryptocurrency Taxation Policies

Under Japan’s existing tax framework, cryptocurrency gains are taxed as miscellaneous income, which can result in a high tax burden and complex calculation methods. This has led to concerns that potential investors might be deterred from engaging with cryptocurrencies such as bitcoin, Ethereum, and other altcoins. To address these issues, authorities plan to revise tax policies by categorizing different types of digital assets more distinctly and providing clearer guidelines for their taxation.

One of the key reforms is to differentiate between various cryptocurrencies and tokens, including non-fungible tokens (NFTs) and decentralized finance (DeFi) assets, which currently fall into a vague regulatory gray area. These changes are expected to streamline the tax process, reduce compliance costs, and promote a more dynamic crypto ecosystem within Japan.

Enhancing Favorability for Blockchain Innovation

By refining its cryptocurrency regulations, Japan aims to bolster the country’s attractiveness as a hub for blockchain startups and crypto exchanges. The reforms are part of a broader strategy to foster innovation in digital finance and integrate new financial products safely into the economy. Additionally, clearer tax rules are expected to enhance transparency, making it easier for investors to report and pay taxes accurately, reducing the risk of legal disputes or penalties.

The move also aligns with global trends where jurisdictions are striving to create more crypto-friendly regulatory environments. Japan’s proactive approach demonstrates its commitment to staying at the forefront of the evolving blockchain and cryptocurrency landscape, encouraging the development of DeFi projects, NFTs, and other innovative digital assets.

Conclusion

Japan’s planned revisions to crypto tax regulations mark a significant step toward supporting the growth of digital assets and blockchain technology within its borders. By simplifying tax procedures and providing clearer guidance, the country hopes to attract more investment and innovation while ensuring a balanced and responsible regulatory framework. As the global crypto industry continues to evolve, Japan’s reforms highlight the importance of adaptive regulation in fostering a sustainable and thriving crypto sector.

This article was originally published as Japan Aims to Cut Crypto Tax Rates from 55% to 20% – Here’s Their Plan on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Ukraine Gains Leverage With Strikes On Russian Refineries

Zhongchi Chefu acquired $1.87 billion worth of digital assets from a crypto giant for $1.1 billion.