Solana Meme Coin Launchpad Pump.fun Rolls Out “Project Ascend” – Can It Finally End Rug Pulls?

Solana-based memecoin launchpad Pump.fun has unveiled “Project Ascend,” a sweeping update it claims will transform its ecosystem and address one of the crypto industry’s most persistent issues: sustainability for token creators.

The announcement sent Pump.fun’s native token PUMP surging more than 10% as traders reacted to the promise of “100x growth” across the platform.

The centerpiece of the rollout is a reimagined creator fee system designed to better align projects with their communities and reduce incentives for short-lived, high-risk token launches.

Pump.fun Revamps Creator Fees in Bid to End Short-Lived Token Hype

At the heart of Project Ascend is Dynamic Fees V1, a new tiered structure applied exclusively to PumpSwap tokens. Instead of charging flat fees, the system reduces creator fees as a token’s market capitalization grows.

Pump.fun says the model will make launching new coins “10x more rewarding,” encouraging fresh talent ranging from streamers to startups, while still allowing successful projects to scale without being weighed down by costs.

Additionally, allocations for protocol fees and liquidity providers remain unchanged, ensuring continuity for the broader ecosystem.

Pump.fun argues the change directly addresses problems with its earlier Creator Fees initiative, which faced community criticism and proved ineffective in covering the costs of building real projects.

According to the team, while the original system offered a proof of concept, it fell short of supporting expensive needs like marketing campaigns, exchange listings, and long-term development.

The updated fee model, combined with faster processing of community takeover applications for inactive tokens, is intended to give legitimate builders a clearer path to sustainability.

The update comes at a key moment for Pump.fun. In recent weeks, the platform has rolled out a series of expansions designed to strengthen its footprint within Solana’s ecosystem.

On July 17, it announced its first acquisition, purchasing wallet-tracking tool Kolscan to integrate advanced analytics and social trading features.

Just days later, the project launched its public token sale, seeking to raise up to $600 million, representing 15% of PUMP’s total supply.

Pump.fun has also introduced a real-time revenue dashboard, reporting over $58 million in token buybacks to date, equivalent to offsetting 4.26% of the circulating supply.

In parallel, Pump.fun launched the Glass Full Foundation, a fund dedicated to injecting liquidity into promising community-driven projects. The initiative, revealed on August 8, has already begun supporting several tokens, planning to accelerate the most vibrant and organic communities on the platform.

More recently, Pump.fun added a Kolscan-powered leaderboard on August 25, allowing users to track top traders and influencers in real time.

Despite the momentum, questions linger about whether Project Ascend can meaningfully curb the plague of rug pulls and failed meme coins.

The platform’s promise of becoming “the hub for the most successful projects and creators” rests on its ability to turn structural incentives into long-term value.

Critics note that while fee reforms may encourage higher-quality projects, they do not directly eliminate the risks of bad actors launching short-lived tokens.

Even so, Pump.fun’s broader strategy appears to be positioning itself as a central hub for Solana startups and meme projects alike.

By combining new fee mechanics, social trading features, liquidity injections, and real-time transparency tools, the platform hopes to strengthen its reputation as more than just a generator of fleeting meme coins.

Pump.fun Surges Past LetsBonk, Capturing 75% of Solana DEX Revenue

Solana’s decentralized exchange (DEX) activity is showing sharp declines after a year of explosive growth fueled by meme coins.

August Data from Dune Analytics shows that daily active traders on Solana DEXs have dropped 81%, from 4.8 million earlier this year to just 900,000 in August. Daily transactions have also fallen, sliding from 45 million in July to 28.8 million this month.

The slowdown marks the fourth straight day that Solana’s trader count has stayed under one million, indicating what many see as the end of the frenzy that drove record volumes in late 2024.

Activity had surged last year as meme coins and experimental tokens dominated trading, with weekly traders peaking above 30 million by October. But inflows collapsed in early 2025, leaving recurring users to sustain activity at a lower baseline of 10–15 million weekly.

Amid this downturn, Pump.fun has staged a comeback after losing ground to Solana-based rival LetsBonk.fun in July. LetsBonk led daily volumes and revenue for nearly a month before Pump.fun reclaimed the top spot in early August.

On August 6, Pump.fun outpaced LetsBonk across all metrics, including tokens minted, trading volume, and revenue.

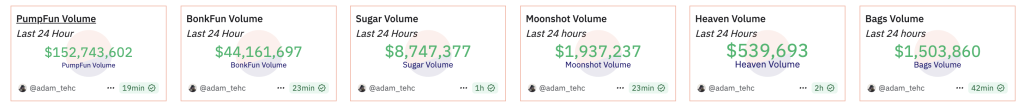

Fresh Dune data from September 2 shows Pump.fun’s dominance, with $1.13 million in revenue over the past 24 hours. BonkFun followed with $381,730, while Sugar ($52,052), Heaven ($12,615), and Bags ($5,854) trailed far behind.

Source: Dune Analytics/ @adam_tehc

Source: Dune Analytics/ @adam_tehc

Combined, Pump.fun and BonkFun account for more than 90% of fee revenue, reflecting a heavily concentrated market.

Token creation trends mirror the revenue gap. Pump.fun users minted 16,697 tokens in the last 24 hours, far ahead of LetsBonk’s 6,087. Pump.fun also led in graduations, with 164 compared to LetsBonk’s 32, though graduation rates remain below 1%, showing high churn across platforms.

Meanwhile, PUMP, Pump.fun’s native token, rallied 14% following the launch of “Project Ascend.” The update builds on a buyback program that has lifted the token 25% in the past week and 32% over two weeks.

You May Also Like

Trump swears he'll donate winnings in $10 billion lawsuit against his own IRS

US President Donald Trump says Warsh would’ve lost Fed if he pledged rate hike