The Movement airdrop has been received: 98.5% of addresses have received more than 100 MOVEs, and the highest single address has received 490,000 MOVEs

Author: Frank, PANews

On December 9, the modular Layer2 Movement based on Move opened airdrop claims. At the same time, many mainstream exchanges such as Binance, OKX, Upbit, and Coinbase competed to list MOVE tokens, becoming the "Grand Slam" players of this year's coin listing. Many users posted the results of their airdrop claims on social media, and many received tens of thousands of MOVE. Some users also said that they missed the opportunity due to the cumbersome airdrop tasks of Movement.

What is the specific situation of MOVE airdrop? Since there is no relevant data dashboard on the market, PANews analyzes the on-chain data of MOVE tokens to investigate the actual situation of MOVE airdrop in this round.

80% of users can receive more than 100 tokens

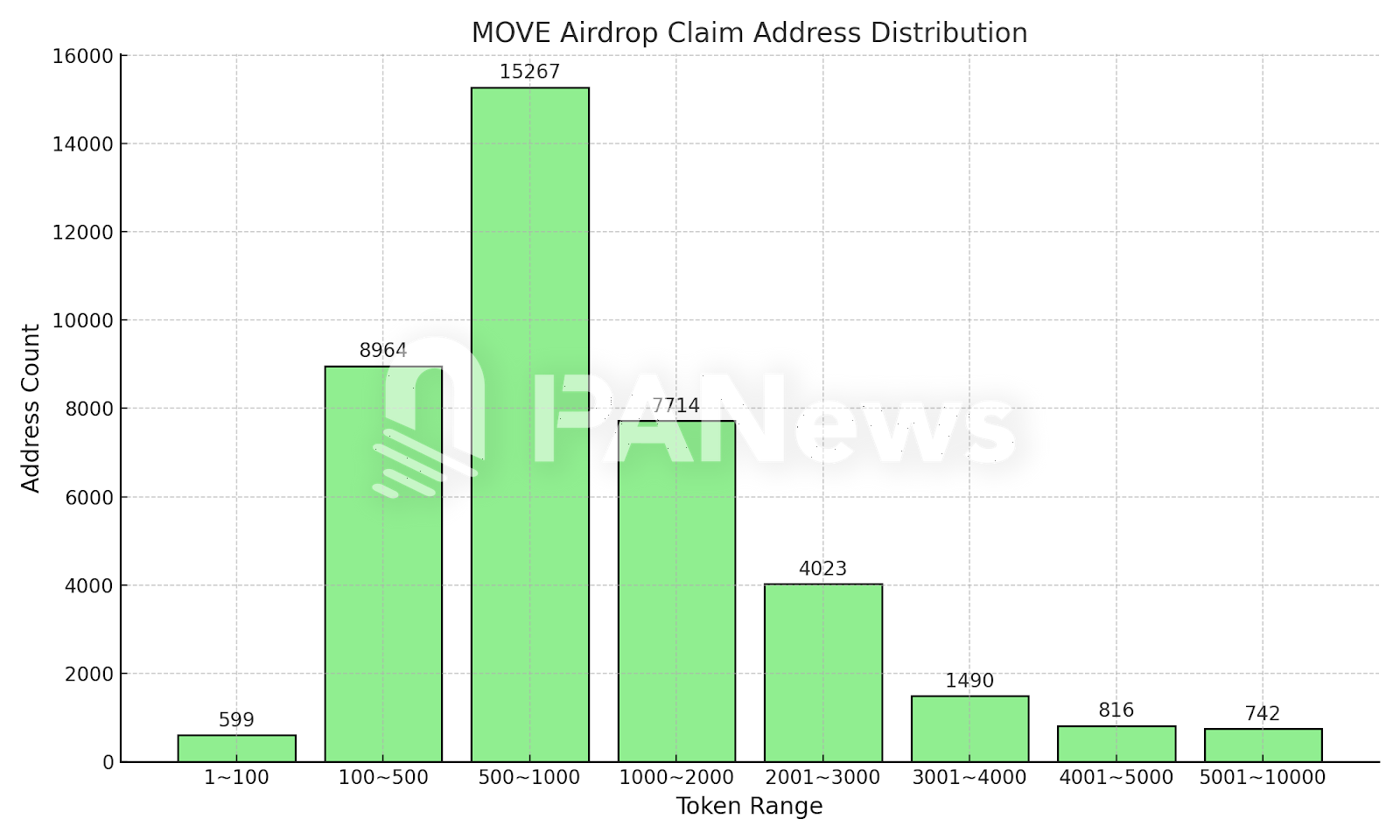

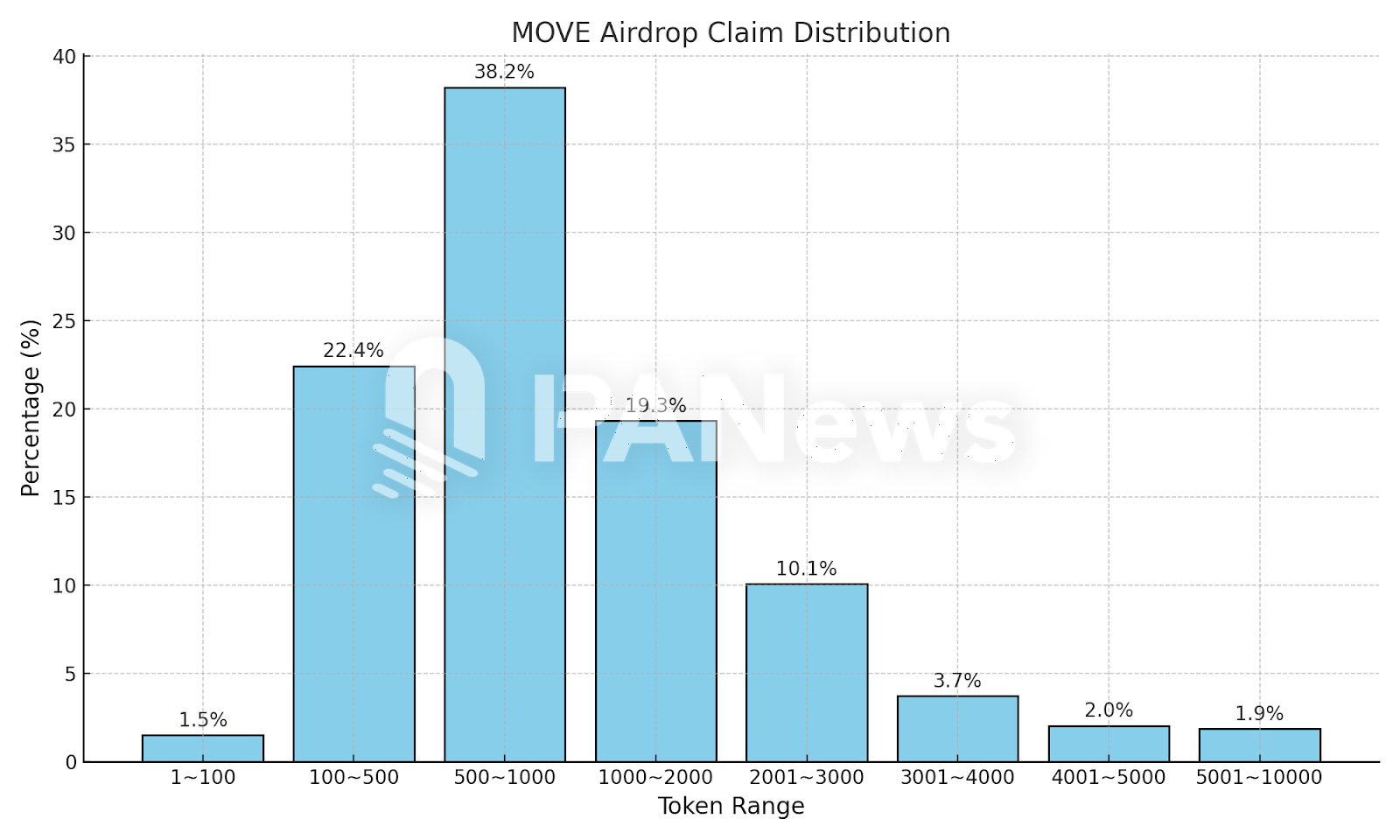

As of December 10, there were 39,900 airdrop claiming transactions on the chain. Among the data of airdrops that have been claimed, there are 429 addresses with a single airdrop of more than 10,000 tokens. There are 6 addresses that have received more than 100,000 tokens. Most users received between 500 and 1,000 airdrops, accounting for about 38.24%. The second largest number of addresses received between 100 and 500 tokens, accounting for 22.45%, and the number of addresses that received between 1,000 and 2,000 tokens was about 19.32%. Overall, addresses with between 100 and 2,000 tokens accounted for 80% of the total.

From the actual effect of the airdrop, the proportion of addresses with less than 100 MOVE tokens is only 1.5%, which is relatively friendly to ordinary users in terms of the number of airdrop allocations. This means that 98.5% of addresses that meet the airdrop qualifications can get an airdrop amount of more than $100. However, the above data is based on the data of airdrops that have been received. According to some social media information, a large number of low-income accounts of airdrop studios have not applied for tokens because their income is difficult to cover the handling fees.

The MOVE airdrop also provided opportunities for some big money-grabbing users. According to PANews’ investigation, some money-grabbing addresses made more than $150,000 in profits in this round of airdrops. For example, the address 0x8f2e314a0081bdcdf304c0e1fdbd8e28ff7a82e4 received 148,000 MOVE tokens through 35 addresses, with the highest value exceeding $215,000. On average, each address received 4,253 tokens.

In addition, the largest single address 0x49130A1938b6498B3D7Cf6B856Afd91e75D8f087 is 493,333.33 MOVE, and the maximum airdrop amount for a single address is about $500,000. At present, the address has transferred the tokens to Binance Exchange and another address. This maximum value is not as high as the largest single address of HYPE, which is $9.56 million , but it is higher than the largest single address of Starknet, which is $360,000, and the largest single address of Jupiter, which is $130,000. However, from the number of addresses, the proportion of addresses that can get airdrops of more than 10,000 tokens is only 1.14%. Relatively speaking, MOVE does take care of ordinary users rather than individual big users from these perspectives. However, the above data is based on the data of airdrops that have been received. According to some social media information, there are a large number of low-income airdrop studios or airdrops that have not yet been received because the airdrops are lower than the handling fee. They may choose to receive them after the Movement mainnet is launched.

The airdrop scale reached 1.45 billion US dollars, exceeding HYPE

According to the total number of airdrops in this round, the maximum airdrop scale of Movement in this round is more than 1.45 billion US dollars, which is higher than the previous airdrop scale of HYPE, which was about 620 million US dollars. According to the official airdrop claiming rules, users can choose to claim on the Ethereum mainnet or wait until the Movement mainnet is launched. According to this ratio, the total amount of airdrops received in this round is about 420 million, and there are still 580 million MOVE airdrops that have not been claimed.

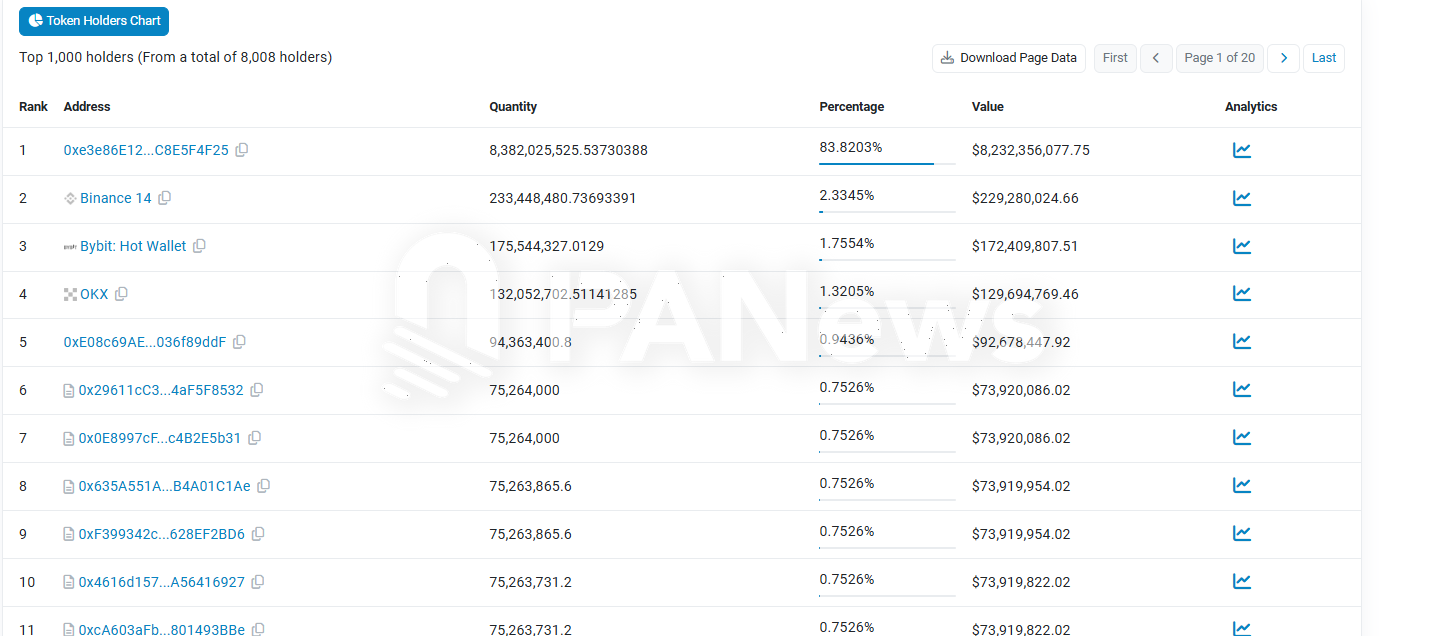

However, PANews found some problems different from the mainstream data platforms through on-chain data. After this round of token TGE, the maximum circulation reported by Movement officially does not exceed 22.5%, and many exchanges including Binance also calculate MOVE's circulation and market value according to this standard. However, on-chain data shows that MOVE's largest official coin holding address still holds more than 83.8% of the tokens, which means that the number of tokens actually circulating in the market is about 1.62 billion, accounting for about 16.2%.

Therefore, if calculated based on the actual situation, MOVE's circulating market value should be $2.349 billion at its highest (calculated at a price of $1.45).

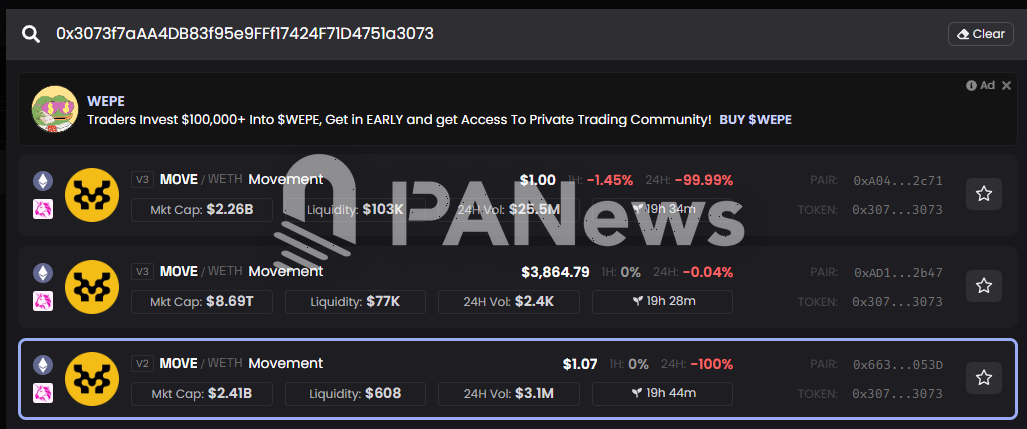

Insufficient on-chain liquidity leads to a price difference of more than 5 times

On December 9, MOVE was launched on multiple exchanges. However, due to insufficient liquidity, the price of the token is quite different between on-chain exchanges and centralized exchanges.

On Uniswap, the price of MOVE reached a maximum of $5.15 on the morning of December 10, while the price on Binance was only $0.96 during the same period, a price difference of 5.3 times. This also provides opportunities for many arbitrageurs. As of the afternoon of December 10, there were 8,199 MOVE token holding addresses on the chain, and the number of on-chain transactions was about 118,000 coins. The total funds of several liquidity pools on Uniswap do not exceed $200,000. For a token with a market value of more than $2 billion, such on-chain liquidity is indeed too poor.

According to the analysis of on-chain analyst @ai_9684xtpa, the Korean exchange Coinone opened the market at 7:30 pm on December 9, resulting in the highest opening price reaching about $700, which forced two other large exchanges, Upbit and Bithumb, to postpone their opening time. The token price in the Korean market is far higher than the exchange prices in other regions. Before 12:00 on December 10, the MOVE price on Korean exchanges such as Upbit has been maintained at more than $2, while the price on exchanges such as Binance does not exceed $1.4. However, as of the afternoon of December 10, the price of MOVE tokens in multiple markets has basically smoothed out the price difference and tended to be unified.

Recently, with the arrival of the altcoin season, many star projects that were previously waiting to issue coins have chosen this time period for airdrops. For players who are keen on airdrops, it can be regarded as a long-awaited rain. Generally speaking, Movement's airdrops are more like sunshine awards, but judging from the on-chain data, there are not many addresses participating in this round of airdrop applications. Perhaps this is also the reason why Movement has achieved a high "minimum living security" level of airdrops. But for investors who try to profit from the speculation of MOVE tokens, perhaps they should pay more attention to the changes in its real liquidity and the ecological construction after the mainnet is launched.

You May Also Like

Cathie Wood's Ark Bets Big On Solana Treasury Play: Makes $162M Investment In Brera Holdings As Stock Explodes 225%

A Reality Check Pi Holders Might Not Want to Hear