Bitcoin Rallies as Markets Anticipate September Rate Cut

The leading cryptocurrency soared to $122K Wednesday morning as the broader crypto market broke the $4 trillion threshold once again this week.

Growing Bets on Fed Rate Cut in September Send Bitcoin Higher

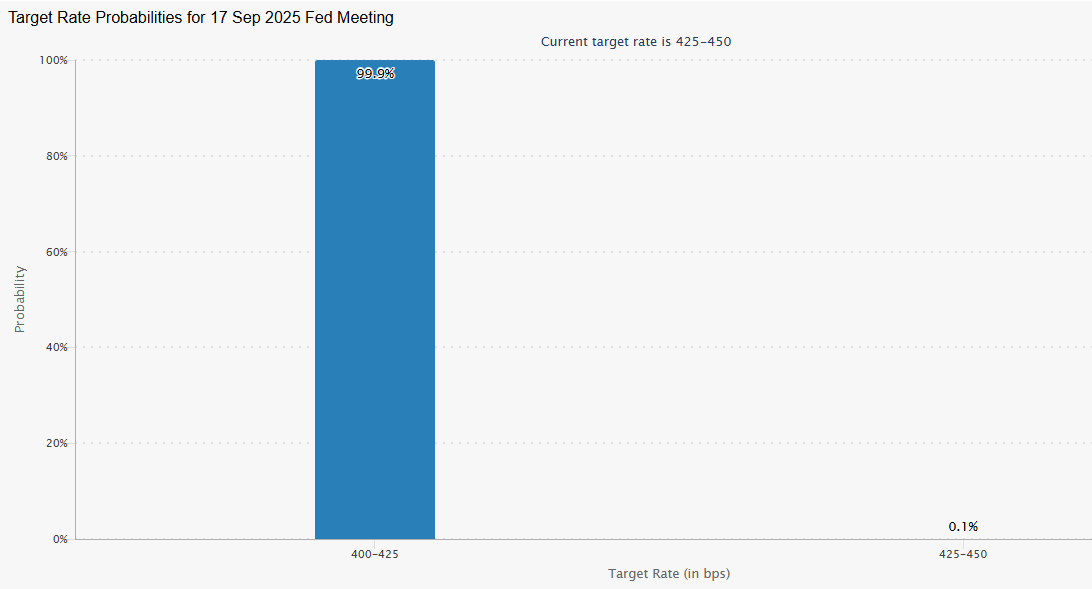

Bitcoin topped $122K on Wednesday as expectations of an interest rate cut by the U.S. Federal Reserve in September increased to 99.9% according to the CME Fedwatch Tool. The digital asset led the charge as cryptocurrencies entered $4 trillion territory for the second time this week.

(The probability of a September rate cut by the Fed is now at 99.9% according to the CME FedWatch Tool / cmegroup.com)

(The probability of a September rate cut by the Fed is now at 99.9% according to the CME FedWatch Tool / cmegroup.com)

The rally has transcended industries, with both stock and crypto markets swelling to near-all-time highs. The S&P 500, Nasdaq, and Dow all jumped 0.12%, 0.05%, and 0.68% on the news. Other cryptocurrencies such as ether ( ETH) also climbed to near-record levels, with the second-largest cryptocurrency soaring past $4,700, just a few hundred dollars shy of its $4,891.70 high, inked nearly four years ago.

The Fed will reconvene mid-September to discuss the level of interest rates in the country. The Trump administration has applied significant pressure on Fed Chair Jerome Powell and his board to cut rates. Two governors disagreed with Powell’s decision to maintain rates at the Fed’s July board meeting, a first in 32 years. Another governor mysteriously quit earlier this month, and will be replaced by Trump nominee Stephen Miran. All of this has pushed the probability of a rate cut to near certainty, and the markets are taking it all in.

Overview of Market Metrics

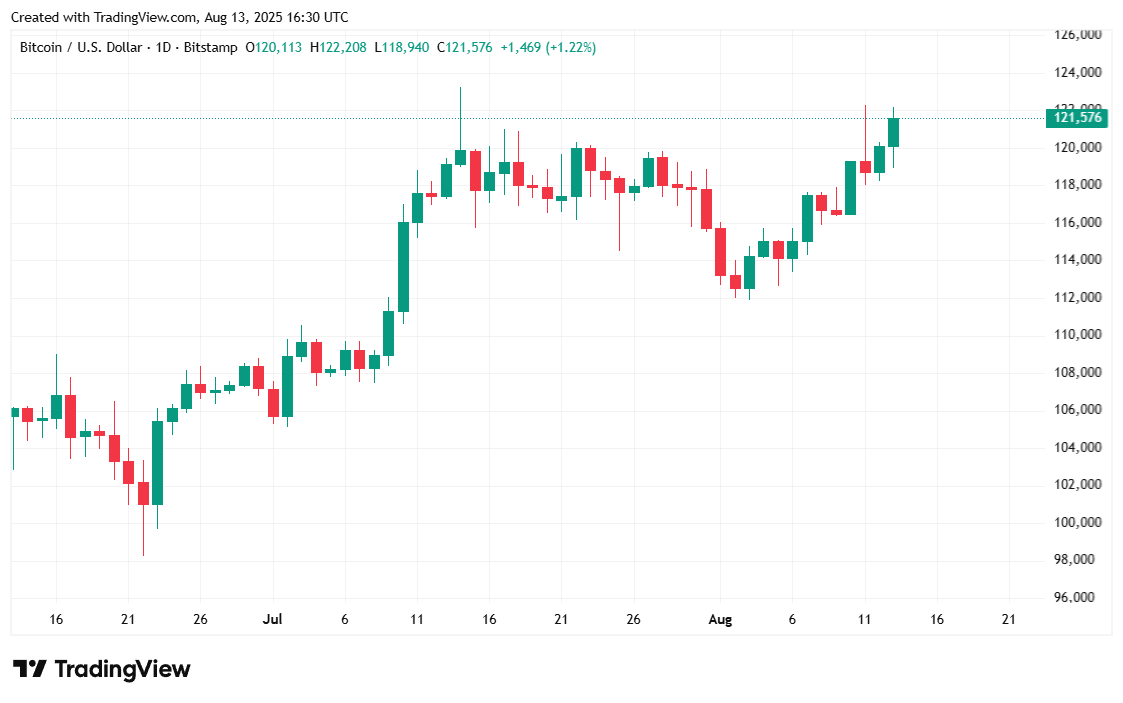

Bitcoin was trading at $121,575.42 at the time of writing, up 1.58% over 24 hours and 5.56% for the week according to Coinmarketcap. The cryptocurrency has traded between $118,939.63 and $122,194.57 since Tuesday.

( Bitcoin price / Trading View)

( Bitcoin price / Trading View)

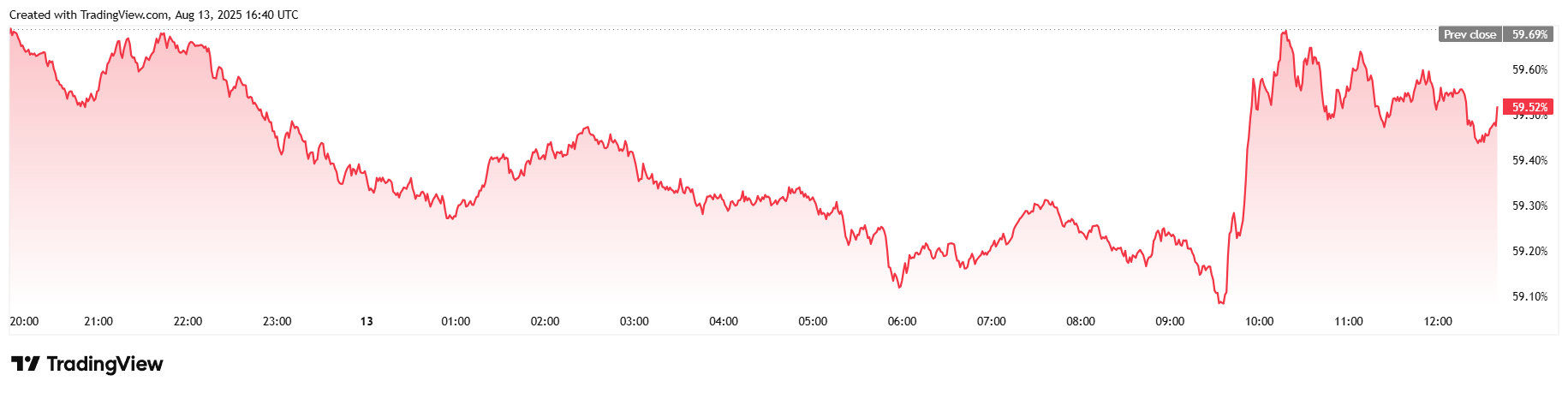

Trading volume over the past 24 hours jumped nearly 12%, reaching $82.38 billion. Market capitalization also increased, climbing 1.76% to arrive at $2.42 trillion at the time of reporting. But perhaps the standout metric was bitcoin dominance, which fell below 60% for the first time since January and stood at 59.50%, down 0.34% from Tuesday. The decrease indicates stiff competition from altcoins such as ether, which has jumped nearly 30% since last week.

( BTC dominance has dipped below 60% for the first time since January 2025 / Trading View)

( BTC dominance has dipped below 60% for the first time since January 2025 / Trading View)

Total bitcoin futures open interest on Coinglass rose 1.61% to $82.13 billion, and BTC liquidations totaled $87.52 million overall. Bears mostly bet the wrong way and had $69.13 million wiped out. Bulls accounted for a smaller portion of the liquidations picture and lost $18.30 million.

You May Also Like

SHIB Price Prediction: Mixed Signals Point to $0.0000085 Target by February End

Fed rate decision September 2025