Should I choose IPO or RWA for financing? This is a question worth considering

Author: Xiao Sa Lawyer Team

In recent years, with the development of blockchain technology and the continuous improvement of the regulatory framework, the tokenization of RWA (Real World Assets) has gradually become the focus of attention in the financial market. Hong Kong, the United States, Singapore and other places have responded and tried to varying degrees. At the same time, the traditional IPO (initial public offering) is still an important way for companies to raise funds. So, what are the similarities and differences between RWA and IPO? What are their respective advantages? How should companies choose? Today, the Sister Sa team will take you to talk about the relationship between the two, in order to provide a reference for companies with different needs when choosing a financing path.

01 Briefly talk about what is RWA and IPO

RWA, or the tokenization of real-world assets, refers to the use of blockchain technology to convert traditional financial assets such as debt, real estate, accounts receivable, fund shares, and bills into digital assets that can be circulated on the chain. This process can not only improve the liquidity of assets, but also reduce transaction costs and improve transparency. For example, a fund company can package the income rights of its real estate projects and issue them as virtual currencies on the chain, allowing investors around the world to participate in transactions with a lower threshold.

IPO, or initial public offering, is the first time a company issues shares to public investors and is listed on a stock exchange. It is the most formal, oldest, and most mature form of financing in the capital market, requiring the participation of three intermediaries: accounting firms, law firms, and securities firms. It must undergo strict financial audits, legal compliance reviews, and the preparation of prospectuses and other documents, marking the company's entry into the public market.

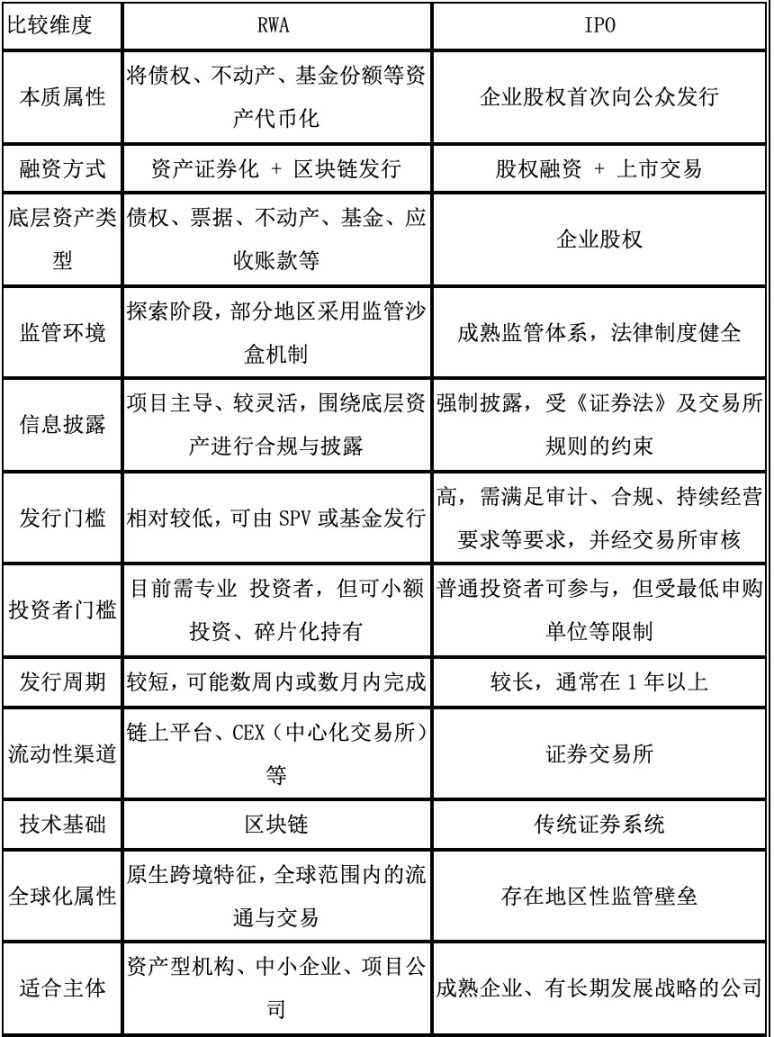

02 A table explains: the main differences between RWA and IPO

03 The respective advantages and characteristics of IPO and RWA

RWA and IPO are similar to a certain extent, but due to their different financing logics, they actually each have their own advantages and characteristics.

As an emerging financing method with the help of blockchain technology, RWA has the following advantages: (1) Low threshold and high efficiency: RWA can split the investment amount as needed, and participation can be made with a few hundred yuan or even tens of yuan, which is suitable for a wider range of investors. (2) Improved liquidity: Assets that were originally difficult to circulate, such as accounts receivable or real estate income rights, can be traded globally on the chain. (3) High issuance efficiency: It does not rely on traditional brokerage processes, does not require long waiting periods, and can be issued quickly after the technology is mature. (4) On-chain transparency: All transaction records are traceable on the chain, enhancing the trust mechanism.

IPO is a traditional financing method for enterprises to enter the capital market. It has the following advantages: (1) High financing amount: Once successfully listed, enterprises can usually achieve hundreds of millions or even billions of financing. (2) Enhanced brand reputation: Listing means passing the strict review of the regulatory authorities, which has a great positive effect on the corporate brand image. (3) Large space for capital operation: Through subsequent additional issuance, mergers and acquisitions, equity incentives and other tools, the capital market can be used to enable corporate efficiency growth in multiple dimensions. (4) Perfect investor protection mechanism: A relatively standardized regulatory environment, mature system and rule of law protect the rights and interests of investors. (5) Broad investor group base: Covering various types of investors such as institutions and retail investors, and sufficient market liquidity.

04 Differences in regulatory preferences between IPO and RWA - Taking Hong Kong as an example

As an international financial center where East meets West, Hong Kong has always been trying to find a balance between traditional finance and emerging finance. In the supervision of RWA and IPO financing methods, Hong Kong has shown a clear "differentiated regulatory orientation": IPO emphasizes strict compliance, information disclosure and investor protection; RWA is relatively open, encouraging innovation but gradually bringing it under control.

Hong Kong's IPO system has long followed the strict framework of the Securities and Futures Ordinance. The listing process is jointly supervised by the Hong Kong Stock Exchange and the Securities and Futures Commission (SFC), covering multiple links such as sponsorship, due diligence, audit review, information disclosure, and public shareholding ratio, ensuring that listed companies have stable financial performance, sustainable operating capabilities, and good governance structures. This strong supervision not only protects the rights and interests of investors, but also enhances the credibility of the Hong Kong market.

In contrast, Hong Kong's regulation of RWAs demonstrates an experimental mindset of "inclusiveness and prudence". In recent years, the SFC has frequently issued regulatory circulars on tokenized assets, gradually established a regulatory sandbox and a licensing system for virtual asset service providers, and included RWA tokens in the category of qualified investment products for regulatory attempts. For example, the "Circular on Tokenized SFC-Approved Investment Products" issued in 2023 clarified for the first time that product providers must be responsible for the management and operational reliability of tokenized arrangements, ensure compatibility with service providers, etc., and should also explain the reliability of relevant arrangements as required by the SFC, and obtain third-party review and verification and legal opinions when necessary, indicating that Hong Kong is trying to achieve a balance between financial progress and investor protection.

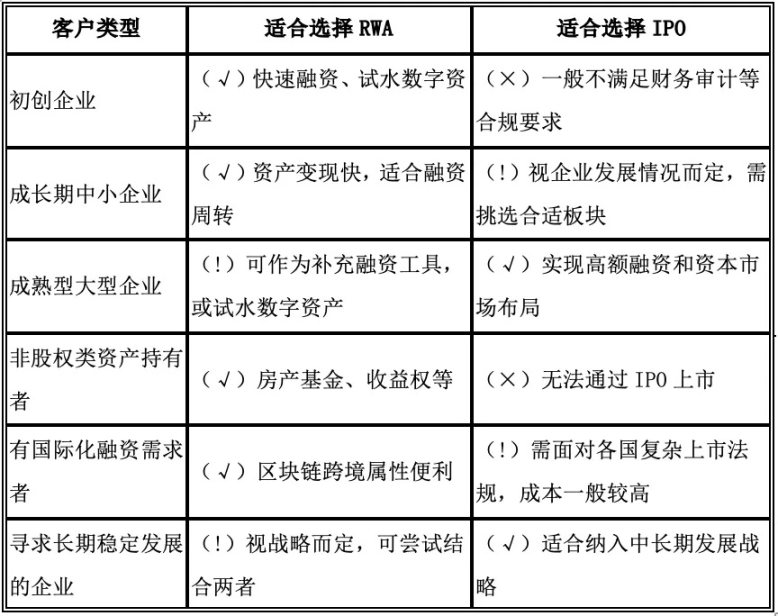

05 One table explains: Which customer groups are suitable for IPO and RWA

06 Conclusion: IPO and RWA - Complementary rather than Substitute

We should realize that RWA is not a substitute for IPO, but a supplement and reshaping of the traditional financing system. It provides unprecedented financing channels for small and medium-sized enterprises and asset holders, and improves financial inclusion; while IPO is still the key path for enterprises to mature and embrace the public market and global capital. For enterprises, they should reasonably choose or combine RWA and IPO according to their own development stage, financing needs, asset structure and strategic layout. In the future, with the maturity of regulatory mechanisms, the reduction of technical barriers and the improvement of market acceptance, RWA and IPO are expected to jointly build a more diversified, transparent and efficient financing ecosystem.

You May Also Like

Federal Reserve’s Rate Cuts May Affect Cryptocurrency Market

‘High Risk’ Projects Dominate Crypto Press Releases, Report Finds