3 Top Cryptos To Buy Today For Short-Term ROI

The post 3 Top Cryptos To Buy Today For Short-Term ROI appeared first on Coinpedia Fintech News

The search for the best cryptocurrency to invest in for short-term gains often leads traders to popular names. Today, many are looking at Dogecoin (DOGE), Ethereum (ETH), and a new contender, Mutuum Finance (MUTM). While DOGE and ETH have big communities, their short-term paths are filled with uncertainty. Dogecoin’s price swings on social media hype, and Ethereum’s progress is slow. This makes a new crypto coin with a clear launch plan very attractive for quick, smart growth.

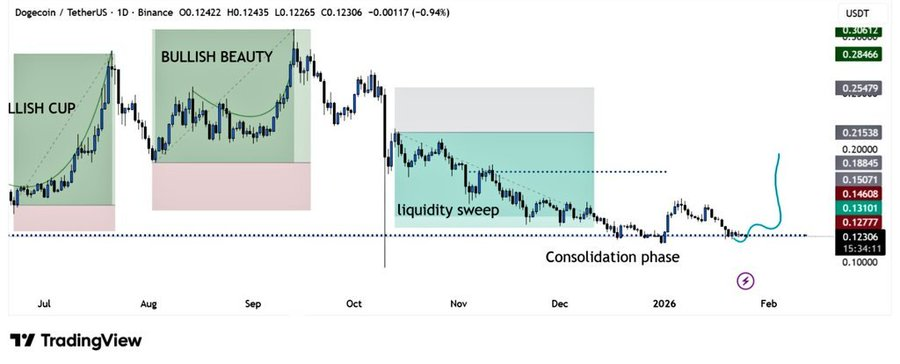

Dogecoin: High Risk From Hype and Volatility

Dogecoin recently saw a huge surge in trading activity, but its core metrics are weak. Its price is falling, and large investors are moving away from it. DOGE often moves based on online trends, not real project development. This makes it a very risky short-term choice. A trader might buy DOGE hoping for a quick rise, but a sudden market shift could wipe out those gains just as fast. For people looking for the best crypto to buy today, this level of unpredictability is a major problem. It is better to find assets with real use and stable growth plans.

Ethereum: Strong But Slow for Short-Term Gains

Ethereum is a very important blockchain, but its price growth has been slow. Data shows that while trading activity has returned, the price of ETH has not followed. It is still much lower than its previous high. Experts think it might reach $4,000 again, but this could take a long time. For a short-term investor, waiting weeks or months for a small increase is not ideal. Ethereum is a good long-term hold, but it is not the top crypto for quick returns right now. Investors want faster opportunities, which newer projects can provide.

Mutuum Finance Presale: The Prime Short-Term Opportunity

Mutuum Finance (MUTM) stands out as the best cryptocurrency to invest in for the short term. Its presale is in Phase 7, with tokens at $0.04. This is the last chance to buy at this price before it increases. The launch price is set at $0.06, but analysts see much higher potential post-launch. Because of high demand and limited supply, some predict the price could jump 8x soon after listing. This means a $200 investment could become $1,600 in a short period. This growth is much faster and more certain than waiting for older coins to move.

Earn Immediate Rewards with Liquidity Mining

Another reason MUTM is a top crypto for short-term action is its liquidity mining program. Users can deposit funds to earn high yields. For example, providing $10,000 in liquidity could earn a 15% annual return. That could mean $1,500 in extra income in one year. But even in the short term, rewards are distributed frequently, providing quick income. This allows investors to earn while they hold, making their capital work for them immediately.

Get Regular Dividends from Protocol Fees

Mutuum Finance has a system that shares its success with token holders. A part of every fee from lending and borrowing is used to buy MUTM tokens back. These tokens are then given to people who stake their tokens in the system. Think of it like getting a cash dividend from a company. If you stake $10,000 in MUTM, you could earn a share of thousands of dollars in fee revenue. This creates a steady stream of extra tokens on top of any price increase. This double earning potential is what makes a new crypto coin like MUTM a powerful short-term asset.

Why MUTM Tops the List for Quick Growth

The V1 protocol launch for Mutuum Finance is a key event that has driven attention and value. While Dogecoin depends on memes and Ethereum moves slowly, MUTM offers a clear plan for rapid growth. Its presale phase offers a low entry point while its liquidity mining provides instant yield and its profit-sharing model rewards holders directly. For any investor making a list of the top cryptos to buy today for the short term, Mutuum Finance (MUTM) presents the strongest case. It combines the high growth of a new launch with real, working products that generate value from day one.

For more information about Mutuum Finance (MUTM) visit the links below:

- Website: https://mutuum.com/

- Linktree: https://linktr.ee/mutuumfinance

You May Also Like

Which Altcoins Stand to Gain from the SEC’s New ETF Listing Standards?

‘High Risk’ Projects Dominate Crypto Press Releases, Report Finds