Binance to Allocate $1B SAFU Fund Into Bitcoin Amid Price Dips

On Jan. 30, crypto exchange Binance issued an open letter to the community. The company said it would move $1 billion from its user protection fund, currently held in stablecoins, to Bitcoin BTC $82 413 24h volatility: 6.1% Market cap: $1.65 T Vol. 24h: $90.77 B over the next 30 days.

The move signals strong confidence in BTC, even as the cryptocurrency faces a sharp price correction.

Binance to Convert $1B SAFU Fund Into Bitcoin

Crypto exchange Binance announced that it plans to move the $1 billion stablecoin reserves held in its Secure Asset Fund for Users (SAFU) into Bitcoin.

The largest crypto exchange has reinforced its view that BTC is the core asset of the crypto ecosystem and a source of long-term value.

Binance said the conversion to Bitcoin will be completed within 30 days of the announcement.

The exchange also confirmed it will continue investing in the broader crypto ecosystem. This comes as Bitcoin’s price drops to around $82,000 amid a broader market correction.

Binance also introduced a new rebalancing framework for the SAFU fund. If the fund’s market value drops below $800 million due to Bitcoin price volatility, the company will adjust the portfolio to restore it to $1 billion.

The exchange called this move part of its long-term commitment to industry development.

Binance added that it will continue to provide updates to the community as the process moves forward.

Binance founder Changpeng Zhao recently said that he expects Bitcoin to enter a potential “super-cycle” in 2026, noting that pro-crypto US policies could alter its usual market rhythm

Bitcoin Price Shows Largest Volatility Increase Since November

Following the massive crypto market sell-off on Jan. 29, Bitcoin’s price has once again come under pressure, slipping to $82,000.

Deribit’s Bitcoin volatility index, also known as DVOL, climbed sharply, rising from about 37 to above 44, signaling a spike in market uncertainty.

DVOL measures the expected volatility of Bitcoin over the next 30 days based on options pricing.

An increase in DVOL shows that traders are paying more for downside protection, which raises options premiums and reflects heightened market anxiety.

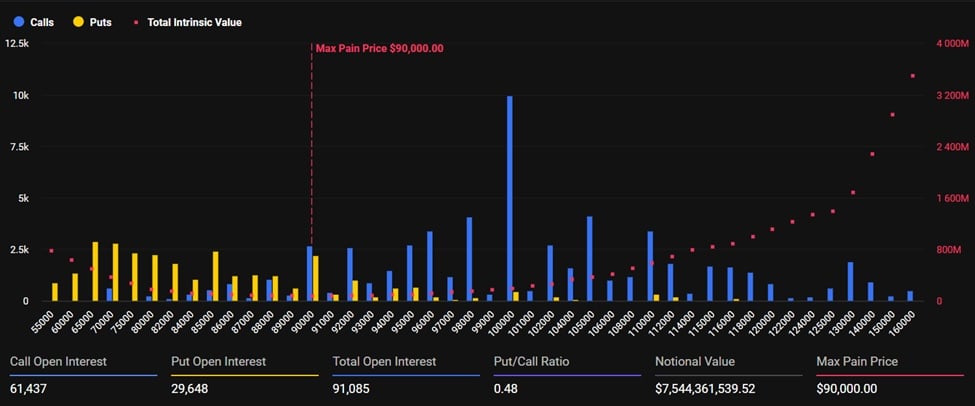

Bitcoin options continue to dominate derivatives exposure, accounting for $7.54 billion in notional value, according to market data.

Bitcoin options expiry chart. | Source: Deribit

Bitcoin is currently trading near $82,761, well below the $90,000 “max pain” level for options expiry.

Despite the recent price pullback, derivatives positioning remains structurally bullish.

Open interest in call options stands at 61,437 contracts, compared with 29,648 put contracts, pushing the put-to-call ratio down to 0.48. Total open interest across Bitcoin options is 91,085 contracts.

nextThe post Binance to Allocate $1B SAFU Fund Into Bitcoin Amid Price Dips appeared first on Coinspeaker.

You May Also Like

MoneyGram launches stablecoin-powered app in Colombia

UAE Central Bank Joins Hong Kong's CMU to Access Chinese Capital Markets