Bitcoin Dips Below $85K as Global Macro Assets Fall

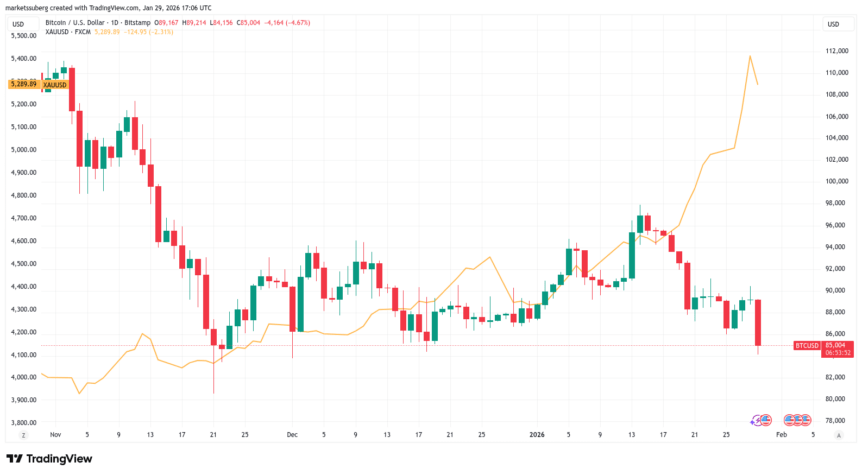

Bitcoin, the flagship asset in crypto markets, slid alongside equities and precious metals as a broad risk-off mood swept through markets on Thursday. The benchmark cryptocurrency breached the $85,000 threshold and extended losses toward two-month lows, with intraday prints around $83,156 on Bitstamp, according to TradingView data. The pullback added to a sense of renewed volatility that has characterized crypto trading as liquidity conditions tightened in late January. At the same time, gold spiked to the upper end of its recent range before giving back some ground, underscoring heightened nerves about macro stability and rate expectations.

Key points:

-

Bitcoin dives below $85,000 as macro assets suddenly tumble from record highs.

-

Gold and silver shock market watchers as nerves over global financial stability grow.

-

BTC price action faces an uphill struggle to avoid a bear market tone at the monthly close.

Gold meltdown catches Bitcoin in its wake

Data from TradingView captured new 2026 lows for Bitcoin, which slipped to about $83,156 on Bitstamp, marking a near-6% intraday drop. The move extended a sequence of declines that traders said reflected a broader shift in risk appetite across macro assets. The price action came as gold traded with heightened intraday volatility, briefly touching the coveted $5,600 level before losing momentum in consecutive minutes, a signal that investors were reassessing hedging plays amid evolving liquidity conditions.

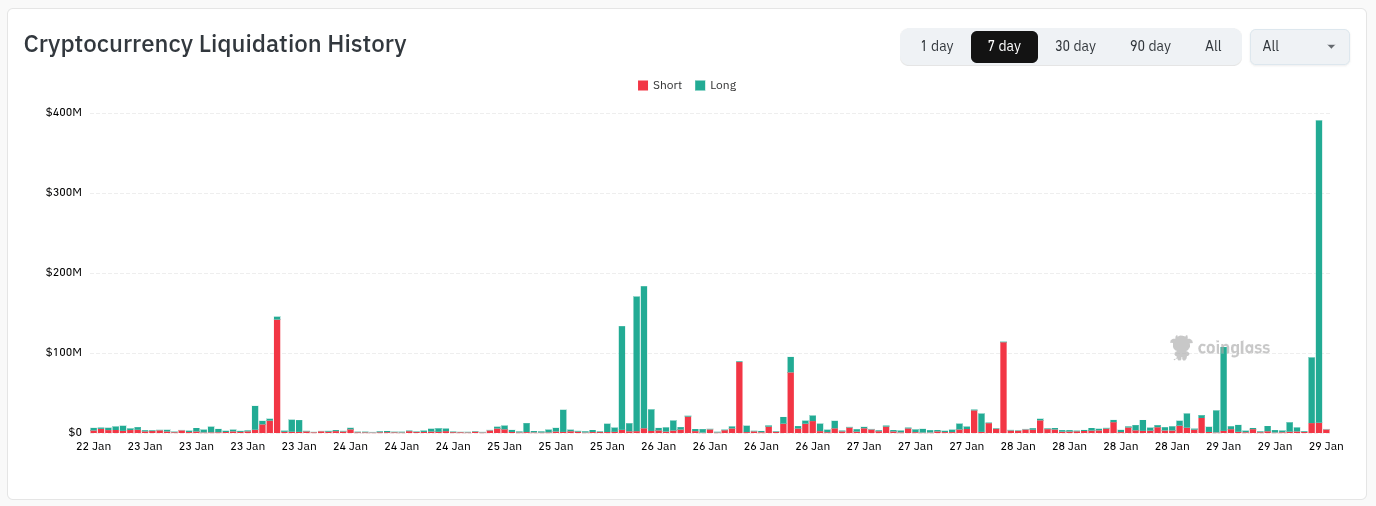

BTC/USD one-hour chart. Source: Cointelegraph/TradingViewSupport at the 2026 yearly open and nearby moving averages failed to stem selling pressure as crypto liquidations crossed the $500 million mark within four hours, underscoring a rapid unwind across long positions. The spike in liquidations highlighted the fragility of leverage in an environment where volatility can surge in a matter of minutes.

Crypto liquidations (screenshot). Source: CoinGlass

Crypto liquidations (screenshot). Source: CoinGlass

The broader sell-off did not spare gold and other risk assets. Gold, which had surged intraday to a historic nominal high, retraced more than $400 within half an hour, a move that surprised some observers given its historical role as a safe-haven asset during periods of macro stress. The rapid swing in precious metals drew attention from traders who had anticipated a more orderly risk-off environment, prompting questions about whether the current dynamic signals a structural shift in how assets react to rate expectations and liquidity shifts.

As the market digested the liquidity crunch, traders attempted to reconcile the sudden drop in Bitcoin with a broader macro narrative. Some argued that the repricing was less about a single catalyst and more about a rebalancing of portfolios as traders reassessed correlations between crypto and traditional assets in a backdrop of shifting policy expectations.

“Wild markets today as Gold and Silver erase trillions in minutes. Yes, BTC goes down during that panic flush, and we’ll probably see some lower levels,” remarked Michaël van de Poppe, a widely followed crypto trader and analyst, in a post on X. He added, however, that a turning point for Bitcoin could be on the horizon, signaling an opportunity for fresh upside if risk sentiment stabilizes.

BTC/USD vs. XAU/USD one-day chart. Source: Cointelegraph/TradingView

BTC/USD vs. XAU/USD one-day chart. Source: Cointelegraph/TradingView

Nic Puckrin, CEO of the crypto education site Coin Bureau, joined the chorus warning that the day’s price action in gold and silver looked unusual for traditional safe-haven assets. He described the move as “insane,” adding that the dollar’s status as a global reserve currency could be facing a reputation test as investors and central banks prepare for turbulence ahead. “They are prepositioning,” he told followers, underscoring the idea that the metals rally was partly hedging against potential shocks in coming weeks.

All eyes on BTC price monthly close

Earlier reporting noted unusual activity on Bitcoin exchange order-books involving an unnamed whale entity that appeared to suppress the price, fueling speculation about manipulation. The story highlighted the fragility of liquidity in a market that has grown increasingly complex, with high-frequency traders and large players capable of moving prices in thinly traded windows. Analysts emphasized that reclaiming the 2026 open by the monthly candle close would be a meaningful signal for bulls, while a close below the key inflection near $87.5k could set the stage for renewed downside pressure.

Keith Alan, cofounder of the trading resource Material Indicators, weighed in on the importance of the monthly close, noting that BTC was testing a critical support level. He cautioned that a close above the Yearly Open would inject some optimism for bulls, whereas a close below the Timelike Level of approximately $87.5k might pave a path toward Bearadise for the rest of the year. The ensuing price action would likely influence traders’ positioning as liquidity cycles evolve and macro conditions unfold.

BTC/USD 1-day candle chart. Source: X/ KAProductions

BTC/USD 1-day candle chart. Source: X/ KAProductions

Market context: The slide follows a broader pattern of macro-driven risk-off moves that have reappeared as investors reassess rate paths, liquidity conditions, and the evolving relationship between crypto and traditional markets. Liquidity stress, rather than a single trigger, appears to be driving the current price action, with traders watching for a stabilization signal before committing to new position sizing.

Why it matters

The week’s price action underscores Bitcoin’s continued sensitivity to macro developments and cross-asset sentiment. A sustained break below the Yearly Open could raise the risk of a more extended downturn, while a decisive close above critical levels might reinstate momentum for bulls and entice fresh buyers who were sidelined by volatility. The episode also highlights how rapidly correlated markets can move when liquidity is tested, reinforcing the need for robust risk management and transparent on-chain signals for participants navigating a volatile landscape.

For investors and developers in the space, the episode serves as a reminder that liquidity prudence remains essential, especially for those relying on leverage or margin-based strategies. The interplay between gold, equities, and crypto continues to be a focal point for risk assessment, with on-chain data and off-chain liquidity metrics providing a composite picture of market health as 2026 unfolds.

What to watch next

- BTC price action around the Yearly Open and the key inflection near $87.5k in the coming daily candles.

- Next round of macro data releases and central bank commentary to gauge liquidity expectations.

- Further liquidity and liquidation signals on platforms like CoinGlass to confirm the persistence or reversal of the current risk-off regime.

- Regulatory developments and institutional positioning that could tilt flows back toward risk-on if conditions stabilize.

Sources & verification

- Bitcoin price prints and intraday levels from TradingView for BTCUSD on Bitstamp.

- Gold (XAU/USD) intraday highs around $5,600 and subsequent pullback.

- Crypto liquidations data from CoinGlass showing totals above $500 million in four hours.

- Public posts from Michaël van de Poppe and Nic Puckrin on X, discussing market dynamics and outlook.

- Earlier Cointelegraph reporting on suspected manipulation in Bitcoin order-books involving a whale entity.

Market reaction and key details

Markets reeled as Bitcoin, the leading crypto asset, confronted a wave of selling across macro-asset classes. The first appearance of a marked price break occurred as liquidity tightened, with BTC dipping below the $85,000 level and trading near $83,156 at one point on Bitstamp, signaling a two-month trough. The rivalry between risk assets and hedging instruments intensified as traders reeled from a liquidations surge that crossed half a billion dollars in just a few hours. In parallel, gold surged to a fresh nominal high around $5,600 before retreating, illustrating the jittery posture of investors who were price-discovering across markets in real time.

As the day progressed, market participants weighed the implications for BTC’s near-term trajectory. Some argued that the weakness was part of a larger risk-off purge that could unwind protective positioning, while others urged caution, noting that a near-term relief rally could materialize if macro conditions stabilize and liquidity returns. A prominent voice in the space observed that the current dynamics may hinge on a decisive monthly close rather than one-off fluctuations, with the Yearly Open acting as a pivotal anchor for sentiment in the weeks ahead.

In parallel, traders and analysts debated the price action in metals and its relationship to digital assets. A widely followed trader noted that the gold rally had proved unstable, suggesting a potential pause in the metal’s run that could affect how investors weigh gold as an insurance asset going forward. The sentiment around BTC remained nuanced, with some observers signaling a potential shift once the market clears the short-term fog and aligns with more definitive macro cues.

Ultimately, the episode highlighted the delicate balance between opportunity and risk in a market that remains highly data-driven and sensitive to policy signals. As the day closed, the evolving story centered on whether Bitcoin could reclaim its critical levels and set the stage for a more constructive trend or whether the sell-off would crystallize into a broader corrective phase.

What matters for participants is the ongoing test of the Yearly Open and the near-term resilience of BTC near the key inflection near $87.5k. The coming weeks will determine whether Bulls regain momentum or the bears extend their grip as liquidity conditions remain a central driver of price action across crypto and traditional markets.

//platform.twitter.com/widgets.js

This article was originally published as Bitcoin Dips Below $85K as Global Macro Assets Fall on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Three dormant wallets, suspected to belong to the same entity, purchased 5,970 ETH eight hours ago.

NVIDIA Stock Price Analysis as OpenAI Issues Concerns About its Chips