Iran Faces Regime Pressure: Polymarket Odds on Khamenei’s Ouster Hit 56%

The US military’s dramatic capture of Venezuelan President Nicolás Maduro last weekend has sent shockwaves through Tehran, where Iran’s leadership now confronts the uncomfortable possibility of a similar fate.

The prediction markets are taking notice.

Traders Price In Regime Risk

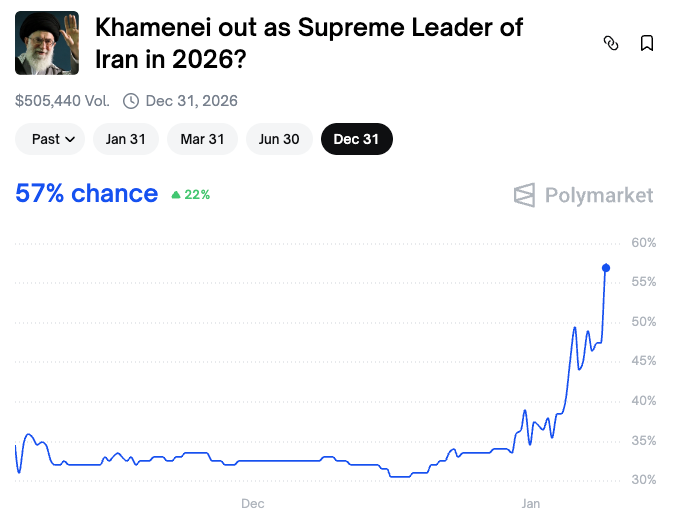

Polymarket traders are pricing in the risk. The probability of Ayatollah Ali Khamenei being removed as Supreme Leader by year-end has surged to 56%, up 21 percentage points in recent days. The spike reflects growing market conviction that Iran’s 85-year-old Supreme Leader may not survive the convergence of internal unrest and external pressure now bearing down on the Islamic Republic.

Venezuela and Iran have been close allies, bound by shared hostility toward Washington. Tehran dispatched oil tankers to help Caracas circumvent sanctions, and the two nations signed a 20-year cooperation agreement. Watching Maduro dragged from his bedroom by American forces has made Tehran’s longstanding warnings about US regime change plots feel uncomfortably prescient.

Source: Polymarket

Source: Polymarket

Protests Spread Nationwide

Protests triggered by Iran’s currency collapse have spread far beyond their origins among shopkeepers. Demonstrations now span 88 cities across 27 of Iran’s 31 provinces, according to the US-based Human Rights Activists News Agency (HRANA). The organization reports at least 34 protesters killed and over 2,000 arrested, though these figures cannot be independently verified.

Khamenei has dismissed some demonstrators as rioters, mercenaries, and foreign-linked agitators, while security forces deploy paramilitary units and reportedly raid hospitals to arrest the wounded.

Trump’s Escalating Threats

President Trump has twice warned Iran in less than a week. Speaking aboard Air Force One, he cautioned that killing protesters would trigger a forceful US response. In a radio interview, he told host Hugh Hewitt that Iran would “pay hell” for such violence.

Trump declined to meet with Reza Pahlavi, son of the deposed Shah, saying it would not be appropriate at this time. Israeli Prime Minister Benjamin Netanyahu’s public support for Iranian protesters has likely deepened Tehran’s siege mentality.

What Prediction Markets Show

Polymarket’s graduated odds reveal trader thinking about Iran’s trajectory. The January 31 market sits at 22% on $4.3 million in volume, March at 35%, June at 42%, and December at 56%. This pattern suggests expectations of prolonged instability rather than imminent collapse.

| Deadline | Probability | Trading Volume |

|---|---|---|

| January 31, 2026 | 22% | $4.3 million |

| March 31, 2026 | 35% | $1.9 million |

| June 30, 2026 | 42% | $1.8 million |

| December 31, 2026 | 56% | $504,000 |

Related markets show 51% odds of President Masoud Pezeshkian’s removal by year-end, while 62% still bet on “Nothing Ever Happens”—reflecting persistent uncertainty about whether pressure will translate into actual regime change.

Why Iran Is Not Venezuela

Despite parallels, Iran presents a fundamentally different challenge. The Islamic Revolutionary Guard Corps has built proxy networks across Lebanon, Syria, Iraq, Yemen, and Gaza, designed to project power and deter attack. Iran’s drone and missile arsenal has proven effective in regional conflicts.

Parliament Speaker Mohammad Bagher Ghalibaf warned that any American action would make all US regional assets legitimate targets. Last summer’s Israeli strikes revealed vulnerabilities but also produced rare national unity, with Iranians across the political spectrum condemning foreign attack.

Khamenei wrote on social media that Iranians who believed in negotiating with America have now witnessed the truth: while Iran negotiated, Washington prepared for war. The prediction markets’ 56% probability represents essentially a coin flip against the Supreme Leader’s survival.

For a regime that has endured 45 years of American enmity, those odds may seem manageable. But Maduro probably calculated his own chances quite favorably until US forces came through his door.

You May Also Like

Federal Reserve’s Rate Cuts May Affect Cryptocurrency Market

‘High Risk’ Projects Dominate Crypto Press Releases, Report Finds