Lighter Team Comes Under Scrutiny for $250 Million in Withdrawals After LIT Token Airdrop

- The Lighter DEX team is facing insider trading allegations after millions in LIT sales.

- The yield farmers on Lighter are exiting the protocol according to data from Bubblemaps.

Days after its historic airdrop event, the team behind the Lighter (LIT) protocol has come under scrutiny. New data shows that some wallets linked to the platform have traded millions of dollars worth of LIT tokens since the airdrop.

Lighter Team Indicted in LIT Sales

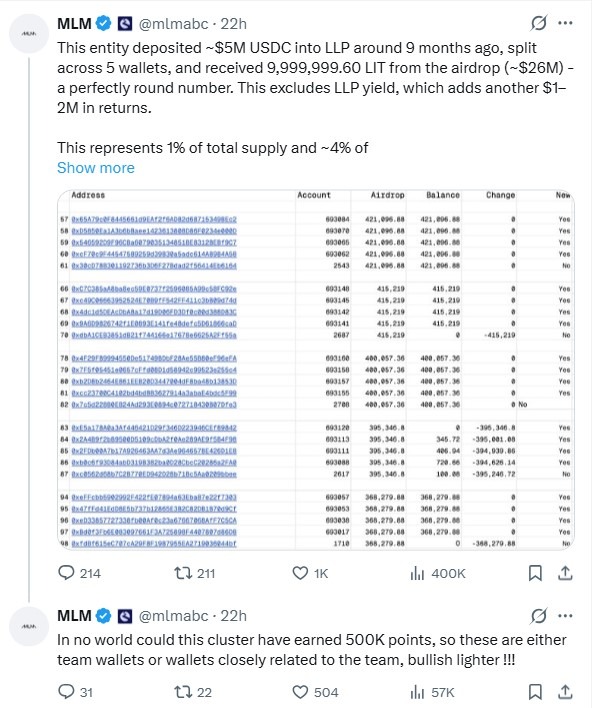

Per market data, the Hyperliquid rival has seen more than $250 million in withdrawals thus far. According to a blockchain researcher, MLM, a wallet seeded the Lighter liquidity pool with 5,000,000 USDC 9 months ago.

This initial capital was split across five wallets, which received a total of 9,999,999.6 LIT from the airdrop. At the pre-market listing price of $3.25, this was worth approximately $32,499,998.7.

Per the data shared by MLM, the almost 10 million LIT allocation excludes the yield accrued from the Liquidity Pool for the 9 months. The tokens under contention mark 1% of the total supply and about 4% of the current circulating supply.

LIT Token Sales Record | Source: MLM on X

LIT Token Sales Record | Source: MLM on X

Although the flagged wallet has sold 2.76 million LIT thus far, the community uproar began when ZachXBT commented on the wallet’s activities. According to the crypto Sleuth, there are signs of insider trading with the protocol, with community members warning of the impact on long-term holders.

The Lighter protocol was designed to serve as a major competitor to Hyperliquid and Aster in the DEX perpetual futures market. As reported in our earlier news piece, the Lighter team unveiled its token, kickstarting its shift as a commercial network.

The success of the airdrop was visible, and it is ranked as the 10th largest in the crypto market’s history. However, the current uncertainty around insider trading may harm LIT’s momentum moving forward.

The $250,000,000 Lighter Withdrawal

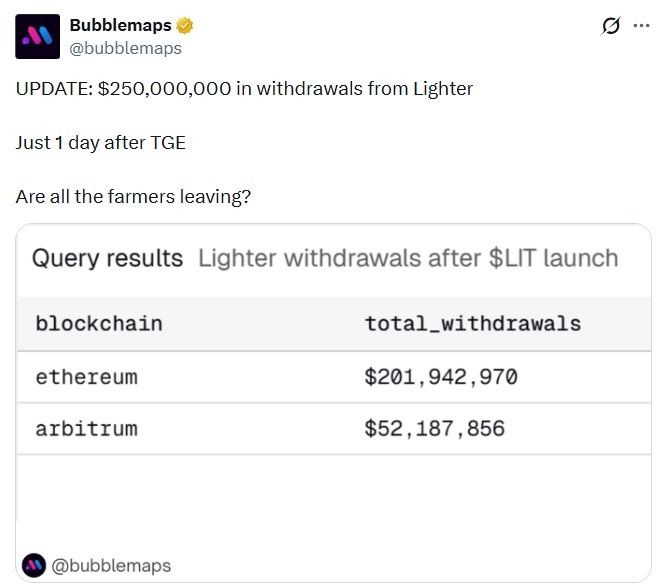

Besides the unclear token sales, there is a major concern around massive withdrawals from the Lighter protocol. According to data from Bubblemaps, within 24 hours of the airdrop, yield farmers have withdrawn about $250 million from the platform.

Lighter Onchain Withdrawals | Source: Bubblemaps on X

Lighter Onchain Withdrawals | Source: Bubblemaps on X

With just a day after the Token Generation Event (TGE), the concerns around liquidity crunch are now growing. As noted by Bubblemaps CEO, Nicolas Vaiman, the withdrawals mark about 20% of the TVL of the platform, with a $1.4 billion TVL.

Lighter is experiencing its major stress test since the LIT launch, a trend that is now impacting the price of the asset.

Per data from CoinMarketCap, the Lighter price was changing hands for $2.65, after registering a 1.77% drawdown in the past 24 hours. While the initial bullish hype around the token has dropped, some of its metrics hint at a potential rebound.

Market data shows that the LIT daily trading volume has rallied by 54% with an actual value of $55 million.

]]>You May Also Like

BitGo expands its presence in Europe

The Definitive Analysis On Whether XRP Can Realistically Reach $5