Dollar Dumps, Bitcoin Pumps: NYDIG Report Could Fuel $HYPER’s Layer 2 Presale

Takeaways:

- NYDIG research reveals Bitcoin thrives on dollar weakness, not inflation protection.

- Interest rates and money supply are the real $BTC price drivers, according to institutional analysis.

- Bitcoin Hyper’s Layer 2 solution addresses scalability as macro conditions favor crypto growth.

- $HYPER presale crosses $25M as investors seek exposure to Bitcoin’s expanding ecosystem.

Apparently, Bitcoin isn’t the inflation hedge the cryptoverse would have us believe it is. Not shocking really.

NYDIG’s global head of research, Greg Cipolaro, just dropped a reality check: the data doesn’t support the inflation hedge story. But before you panic-sell your stack, remember that Bitcoin absolutely crushes it when the US dollar looks weak, and right now, that’s exactly what’s happening.

Source: NYDIG

Source: NYDIG

According to NYDIG’s latest research, the correlation between Bitcoin and inflation measures is ‘neither consistent nor extremely high.’ Ouch.

But Bitcoin shows a clear inverse relationship with the dollar. So when the greenback wobbles, $BTC goes brrrr.

And with current monetary policies keeping things loose and the dollar index looking shakier than a first-time trader’s hands during a dip, we’re potentially staring down the barrel of serious Bitcoin appreciation.

Cipolaro points out that interest rates and money supply are the real puppeteers pulling Bitcoin’s strings. Bitcoin likes loose monetary policies and falling interest rates.

The research suggests Bitcoin has evolved from its wannabe ‘digital gold’ phase into a liquidity barometer for global markets. As Bitcoin becomes more integrated into traditional finance, whether we like it or not, this inverse dollar correlation is expected to strengthen.

That’s why Bitcoin Hyper ($HYPER) is not just a project that’s riding the wave, but building the surfboard for it.

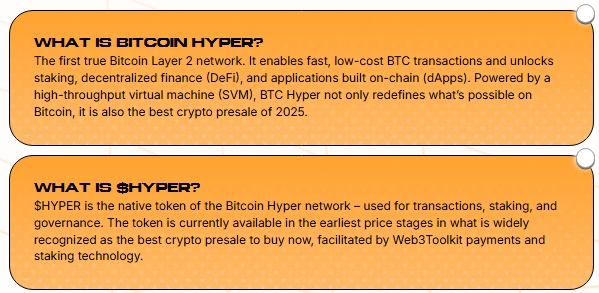

Bitcoin Hyper ($HYPER) Presale Explodes Past $25M as Demand for a Bitcoin Layer 2 Heats Up

While macro conditions align perfectly for Bitcoin’s next leg up, there’s one glaring problem that’s haunted $BTC since day one: it’s painfully slow and expensive to actually use.

Bitcoin Hyper solves this with the first real Bitcoin Layer 2, a legitimate execution layer built using Solana’s Virtual Machine. This means Bitcoin with sub-second transactions, near-zero gas fees, and full cross-chain compatibility with Ethereum and Solana.

The $HYPER presale has already crushed past $25M, and it’s not hard to see why. As NYDIG’s research confirms that Bitcoin thrives in the exact macro environment we’re entering, investors are piling into projects that expand Bitcoin’s actual utility.

$HYPER is the fuel for the entire ecosystem. Staking rewards, priority access to token launches, governance rights, and airdrops all flow to presale participants.

$HYPER is the fuel for the entire ecosystem. Staking rewards, priority access to token launches, governance rights, and airdrops all flow to presale participants.

If NYDIG is right, we’re entering a period where dollar weakness drives Bitcoin higher. That means capital flows into the Bitcoin ecosystem, and the projects that actually solve Bitcoin’s biggest limitations stand to benefit most.

Join the Bitcoin Hyper presale now for just $0.013175 and secure 47% staking rewards.

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post Dollar Dumps, Bitcoin Pumps: NYDIG Report Could Fuel $HYPER’s Layer 2 Presale appeared first on Coindoo.

You May Also Like

Marathon Digital BTC Transfers Highlight Miner Stress

This U.S. politician’s suspicious stock trade just returned over 200% in weeks