Tesla (TSLA) Stock: Analyst Explains Why You Should Own It Today

TLDR

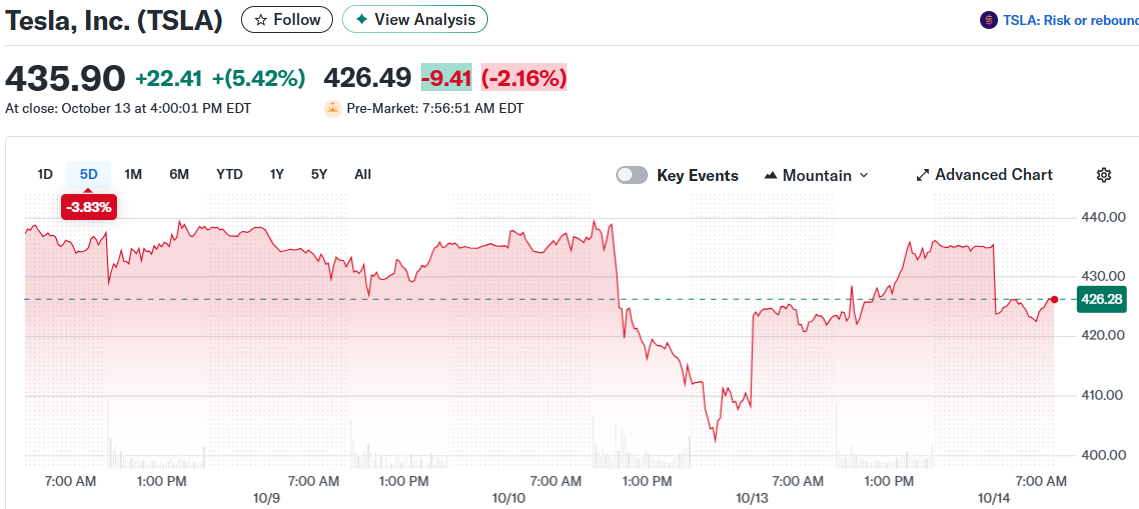

- Melius Research analyst Rob Wertheimer initiated coverage on Tesla with a Buy rating and $520 price target, representing 19% upside potential

- Tesla stock rose over 5% and is up 72% in the past six months as analyst praises company’s AI capabilities and autonomous driving technology

- Analyst believes Tesla and Elon Musk’s companies are best positioned to benefit from AI revolution in automotive industry

- Tesla’s automotive gross margin declined to 17.2% from 28.5% peak in 2022 as competition increases and company cuts prices

- TipRanks consensus shows Hold rating with average price target of $366, implying 16% downside from current levels

Tesla shares jumped more than 5% as Melius Research analyst Rob Wertheimer kicked off coverage with a Buy rating. The stock has now climbed 72% over the past six months.

Tesla, Inc. (TSLA)

Tesla, Inc. (TSLA)

Wertheimer set a price target of $520. That implies potential upside of 19% from current trading levels around $436.

The analyst described Tesla as essential for investors looking to capitalize on artificial intelligence. He believes the company will lead the next wave of change powered by AI technology.

Wertheimer pointed to Tesla’s position at the intersection of automotive and AI. He said the company can manage and use computing power better than most rivals.

The analyst praised the speed of innovation at Tesla, SpaceX, and xAI. He noted that xAI is deploying new data centers faster than almost anyone in the AI sector.

Tesla’s flexible manufacturing approach got a mention too. Wertheimer recalled how building cars in tents seemed risky but worked out well.

Self-Driving Technology Takes Center Stage

The analyst sees autonomous driving as Tesla’s first major real-world AI application. Tesla’s experience with both hardware and data gives it an edge over competitors.

Wertheimer wrote that Tesla can improve and scale self-driving faster than anyone else. He views this as just the start of broader AI changes coming to many industries.

But he cautioned that full autonomy will take time. Soft demand for electric vehicles could also hurt near-term results.

Tesla has gained 186% over the past five years and 2,710% over the past decade. Those returns came largely from investors betting on future potential rather than current fundamentals.

The company’s automotive gross margin tells a different story. This metric shows pricing power and the health of Tesla’s core EV business.

Core Business Faces Margin Pressure

In the second quarter, Tesla’s automotive gross margin was 17.2%. That’s down from 28.5% in 2022, which was the company’s most profitable year.

The EV market has become more crowded. Tesla faces competition from both domestic and international manufacturers.

The company has cut prices to boost demand. This strategy has pressured margins across the business.

Tesla’s recent financial performance shows sensitivity to economic conditions. The last couple years look more like a traditional automaker than a high-growth tech company.

Year-to-date, Tesla stock has gained 7.9%. The shares are trading well above the TipRanks consensus price target.

TipRanks shows a Hold rating based on 16 Buy ratings, 13 Hold ratings, and nine Sell ratings. The average price target sits at $366, which would represent 16% downside from current levels.

Wertheimer’s $520 target stands well above the consensus view. His coverage launch contributed to yesterday’s price jump of over 5%.

The post Tesla (TSLA) Stock: Analyst Explains Why You Should Own It Today appeared first on Blockonomi.

You May Also Like

Bad News for European Crypto Holders? EU Calls For Harsher Crypto Regulation Despite MiCA

Here’s Why This Analyst Predicts Shiba Inu 568% Surge